Executive Summary

Global supply chains are being redesigned under the combined pressure of cost inflation, geopolitical risk, and rising customer expectations, turning Supply Chain Management (SCM) software into a strategic board‑level lever rather than a back‑office tool. The SCM software market, already valued in the tens of billions of dollars, is on track to grow at roughly 9–12 percent CAGR through 2030, powered by cloud adoption, e‑commerce expansion, and demand for real‑time visibility. Leading implementations of advanced SCM solutions have demonstrated tangible results such as 10–20 percent reductions in inventory levels, 5–10 percent reductions in end‑to‑end supply chain costs, and measurable improvements in service levels and on‑time delivery.

As enterprises move into 2026, adoption of AI‑enabled planning, digital supply chain control towers, and advanced automation continues to accelerate across leading organizations. This guide equips CEOs, COOs, and Chief Supply Chain Officers with a concise view of how the market is evolving, a leadership‑ready evaluation lens grounded in SoftwareVerdict’s research methodology, and a curated list of leading platforms that frequently appear in enterprise shortlists. The goal is to help executive teams quickly narrow the field to a manageable set of candidates, structure more effective RFPs and demos, and ultimately approve SCM investments that deliver measurable impact on resilience, service levels, and working capital.

Supply chain leaders are under pressure to improve resilience, cost efficiency, and visibility while managing increasingly complex global networks and multi‑tier supplier ecosystems. Disruptions—from logistics bottlenecks to commodity volatility and geopolitical shocks—have made SCM performance a recurring topic in board and earnings discussions.

In this context, robust SCM software has shifted from being a support‑function tool to a strategic enabler of growth, risk management, and customer experience. Modern platforms provide integrated planning, execution, and analytics capabilities that help leadership teams align operations with commercial and financial objectives.

This guide is designed as a leadership‑ready brief, not a technical manual. It focuses on three core questions executive teams typically ask when sponsoring an SCM transformation:

How is the SCM software market evolving (size, growth, and technology trends) as we move through 2026?

What lens should leadership use to evaluate SCM platforms in a structured, comparable way?

Which 8–10 platforms most frequently appear in enterprise shortlists, and how do they typically position?

By the end, readers should be able to convert this guide into an internal shortlist, an RFP evaluation matrix, and a set of scenario‑driven demo scripts.

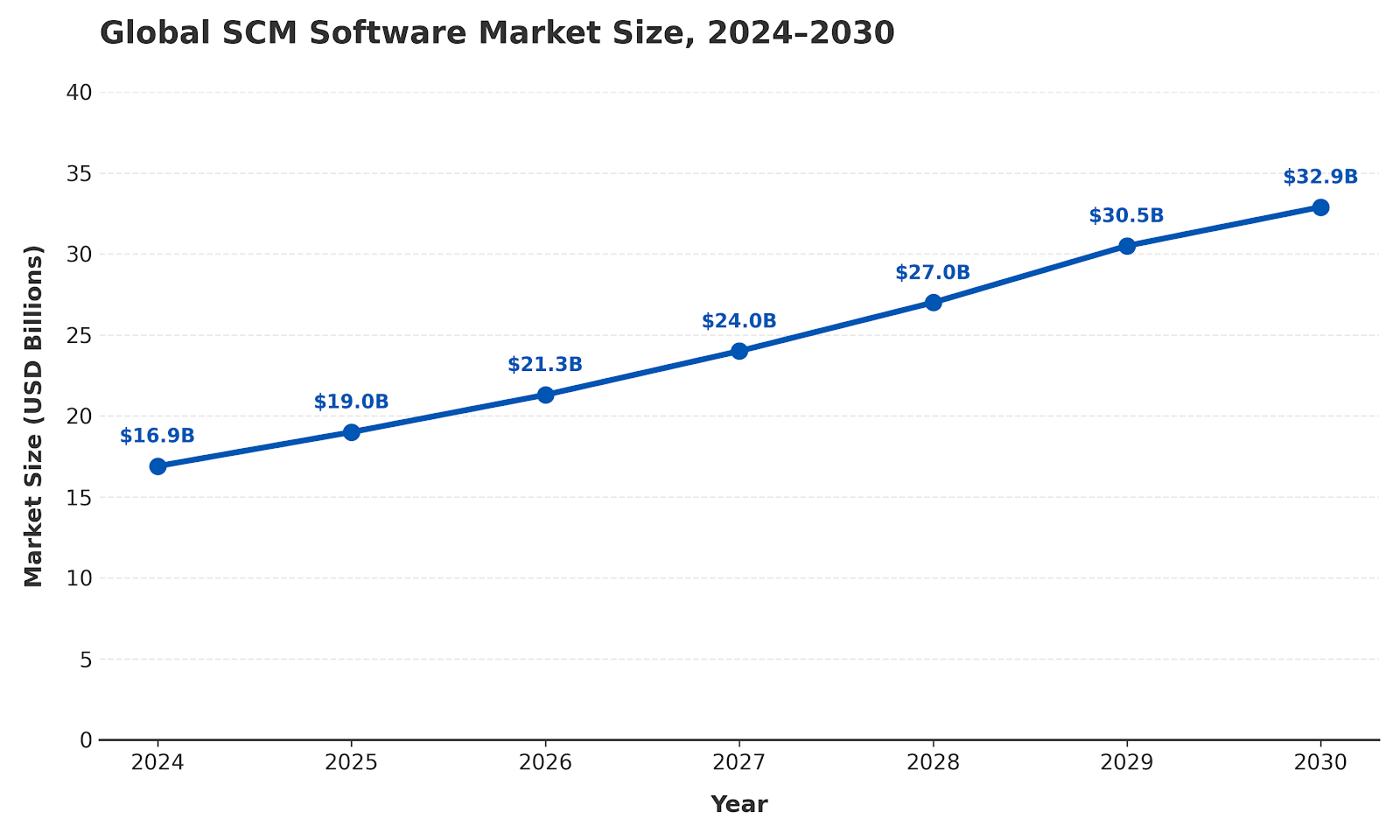

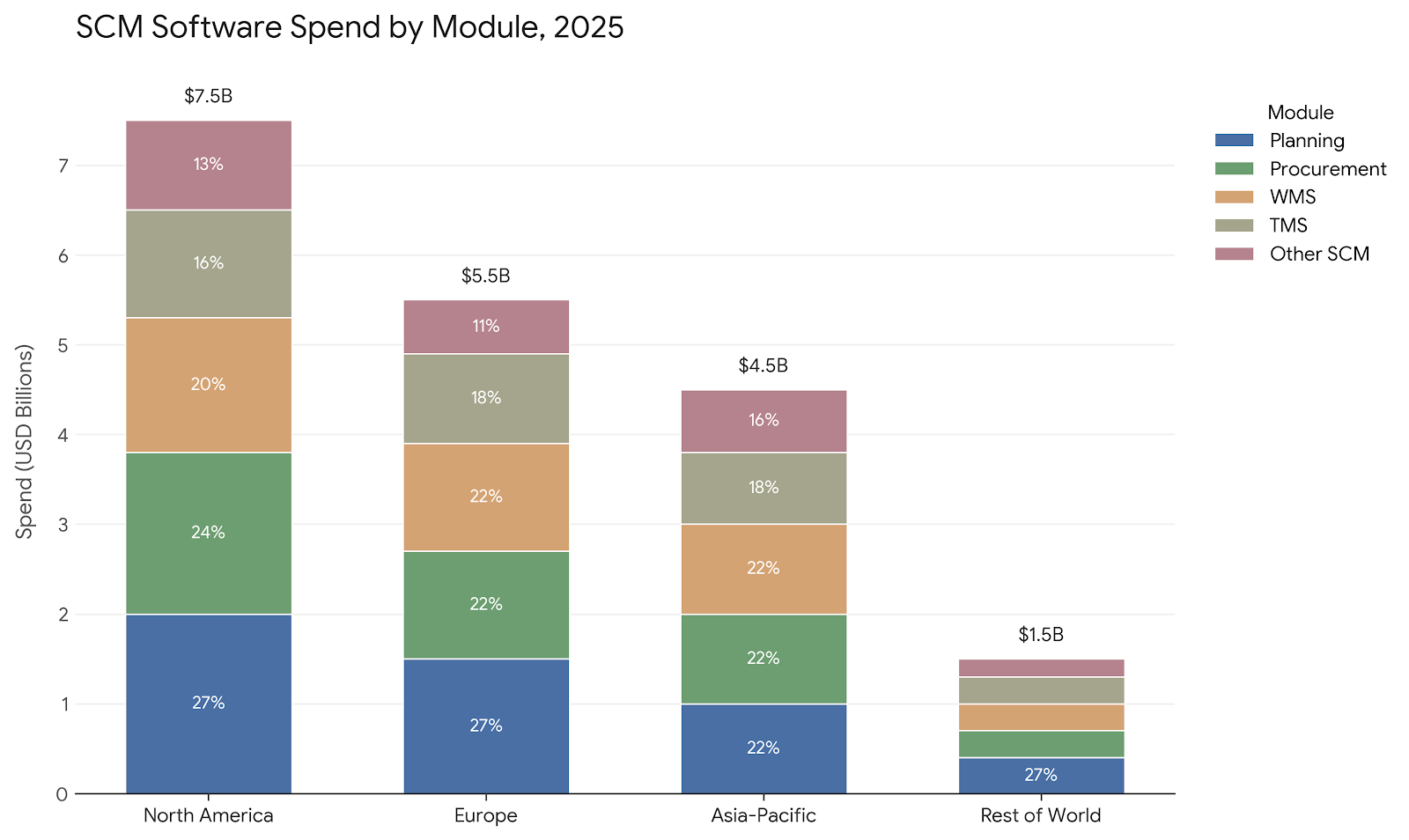

Analysts estimate the global SCM software market in the USD 20–30 billion range in the mid‑2020s, with forecasts suggesting expansion to roughly USD 50 billion or more by 2030. This implies high single‑ to low double‑digit CAGR, outpacing many other enterprise software segments as supply chain digitalization accelerates.

Growth is fueled by e‑commerce, multi‑tier supplier networks, labor and logistics disruptions, and the need for end‑to‑end transparency across planning, procurement, warehousing, transportation, and fulfillment. At the same time, cloud and SaaS delivery models lower entry barriers and enable faster rollouts across regions and business units.

In 2026, enterprises are also prioritizing AI‑driven decision support, supply chain risk management, and sustainability reporting within their SCM technology roadmaps. These priorities are pushing buyers toward platforms that combine strong operational capabilities with advanced analytics and ecosystem connectivity.

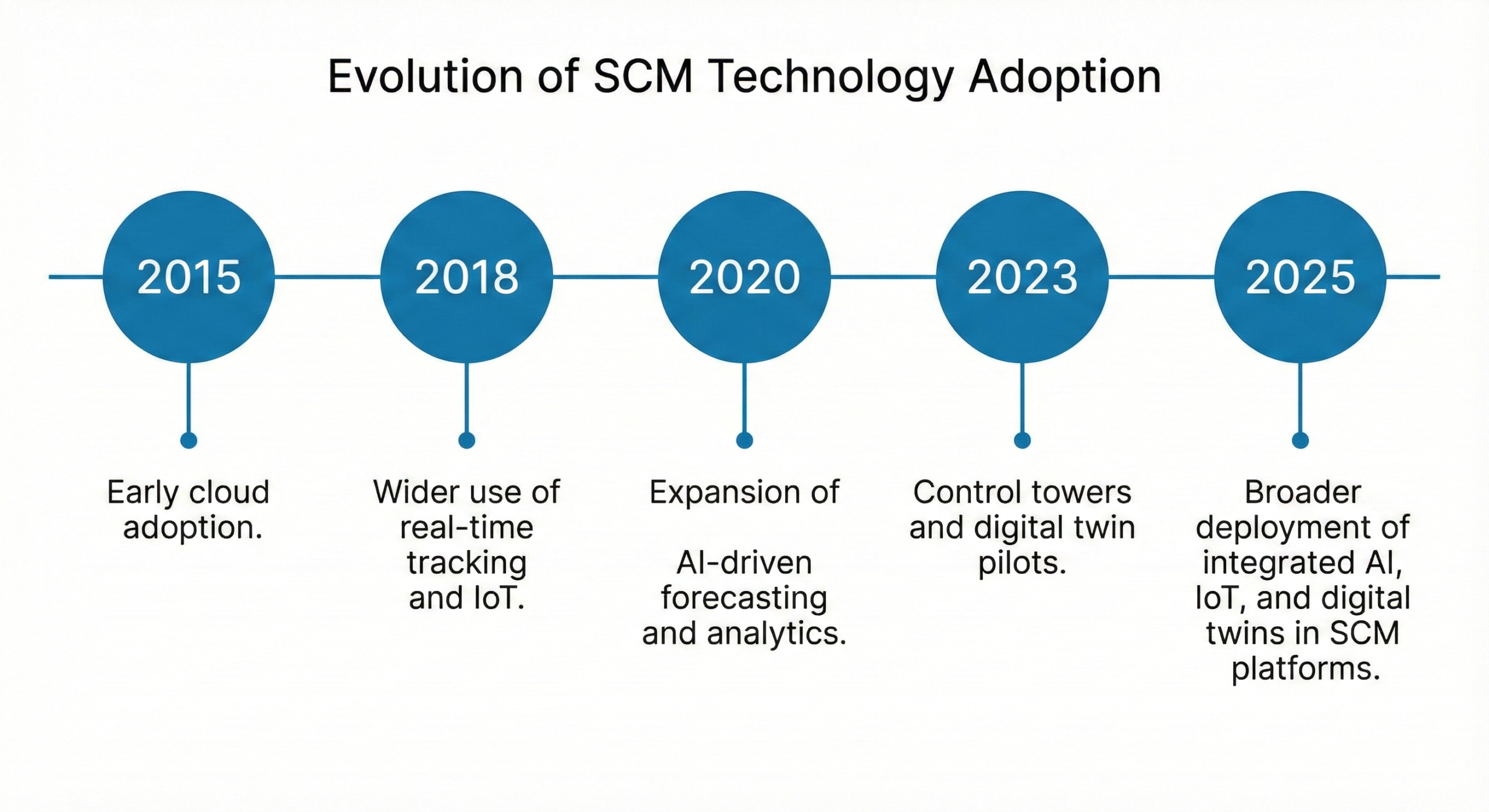

Cloud‑first and modular suites are replacing monolithic on‑premise systems, allowing organizations to phase implementations and integrate best‑of‑breed modules where needed.

AI, predictive analytics, and digital twins are improving forecasting accuracy, scenario planning, and risk sensing across demand, supply, and logistics.

IoT, real‑time tracking, and control‑tower capabilities provide continuous visibility from suppliers to customers, enabling proactive exception management.

For C‑suite leaders, these shifts translate into faster time‑to‑value, richer decision support, and better alignment between operations and financial targets.

SoftwareVerdict’s research methodology evaluates software across quantitative and qualitative lenses so buyers can compare like‑for‑like rather than relying on marketing claims. Adopting a similar lens internally helps executive sponsors frame selection discussions in business terms rather than feature checklists.

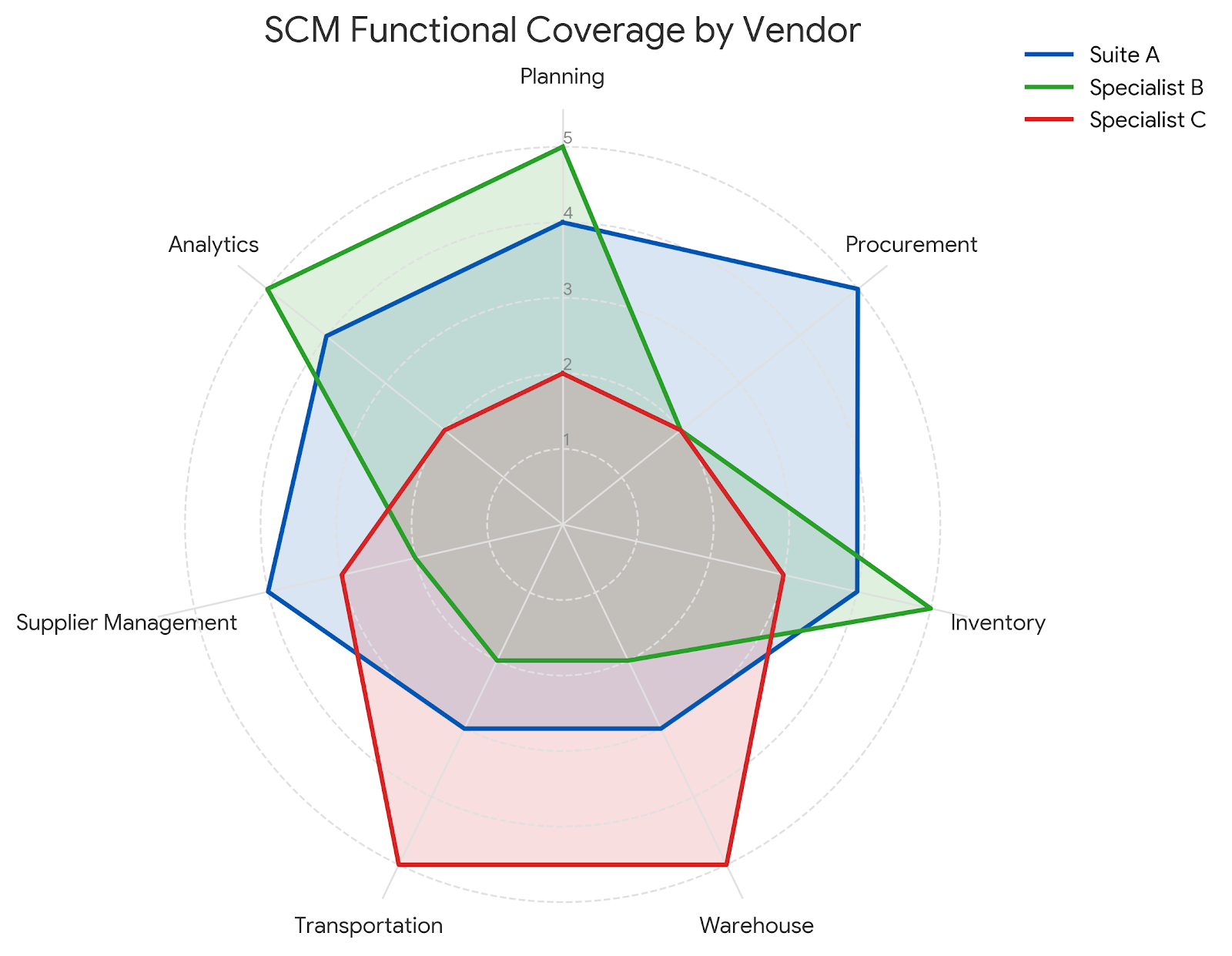

Leaders should first verify that candidate platforms cover the end‑to‑end process scope relevant to their strategy. Key functional domains include:

Supply chain planning and S&OP (demand planning, supply planning, inventory optimization).

Procurement and sourcing, including supplier onboarding, RFx, and contract visibility.

Inventory, warehouse, and transportation management, including integration with carriers and 3PLs.

Supplier management and after‑sales or returns management, especially for complex product portfolios.

The priority is not to maximize features, but to align functional depth with the three to five strategic supply chain objectives the organization has set.

From a technology perspective, leadership teams should assess:

Cloud vs on‑premise deployment options, including data residency and cybersecurity posture.

Integration capabilities and API ecosystem, especially with ERP, CRM, WMS, TMS, and analytics platforms.

Data model maturity, scalability, and support for near real‑time data ingestion from IoT and external sources.

Architecture choices will influence implementation risk, internal skill requirements, and the ability to adopt new modules over time.

SoftwareVerdict’s Economic Impact Radar® framework emphasizes quantifying outcomes such as cost, revenue, and risk impact when evaluating software investments. For SCM, typical impact levers include:

Reductions in inventory and working capital through better planning and stocking policies.

Lower logistics and fulfillment costs via improved routing, load optimization, and carrier management.

Improved service levels and on‑time delivery through better visibility and exception handling.

Executive sponsors should request that vendors provide reference case studies and indicative business cases aligned with these metrics.

User satisfaction, adoption, and referenceability are critical leading indicators of long‑term value. Leadership teams should consider:

Independent ratings and reviews, especially on implementation quality and support.

Regional and industry‑specific strengths, including references in similar supply chain and regulatory environments.

Evidence of continuous innovation and product roadmap execution.

This leadership lens can be translated into an internal scorecard or RFP evaluation matrix with weighted criteria and clear decision thresholds.

The following platforms frequently appear in enterprise shortlists; this section is illustrative and not a ranking or endorsement.

These vendors are often selected when organizations prioritize tight ERP–SCM integration and a single strategic platform:

SAP SCM / SAP Integrated Business Planning (IBP) – Strong in complex manufacturing and global enterprises, with deep integration into SAP ERP and robust planning and analytics capabilities.

Oracle SCM Cloud – Cloud‑native suite spanning planning, procurement, inventory, logistics, and product lifecycle management, suited to organizations moving aggressively to SaaS.

Microsoft Dynamics 365 Supply Chain Management – Integrated with the broader Dynamics 365 ecosystem, combining SCM, finance, and CRM capabilities, attractive for Microsoft‑centric environments.

Infor Supply Chain – Known for strong vertical depth in sectors such as manufacturing, food and beverage, and distribution, often deployed in organizations seeking industry‑specific capabilities.

Specialist vendors are frequently chosen where domain depth or advanced optimization is a priority:

Kinaxis – Recognized for concurrent planning, scenario analysis, and rapid response capabilities, often used in high‑complexity, high‑volatility supply chains.

Blue Yonder – Strong in AI‑driven planning, demand forecasting, and logistics optimization, with a focus on retail, consumer goods, and logistics‑intensive industries.

Manhattan Associates – Known for warehouse and transportation management depth, particularly in retail and omni‑channel logistics environments.

E2open and similar platforms – Offer extensive multi‑enterprise network capabilities, collaboration, and visibility across trading partners.

Enterprise buyers often shortlist a mix of suite vendors and specialists, then assess trade‑offs on integration complexity, time‑to‑value, and domain depth in the context of their own operating model.

| Vendor category | Example platforms | Primary strengths | Best for | Typical deployment |

|---|---|---|---|---|

| Large‑suite leaders | SAP, Oracle, Microsoft, Infor | End‑to‑end ERP–SCM integration, global scale | Multinational enterprises with complex IT estates | Predominantly cloud/hybrid |

| Best‑of‑breed planning | Kinaxis, Blue Yonder | Advanced planning, forecasting, scenarios | Volatile demand, complex networks | Cloud/SaaS |

| Execution specialists | Manhattan Associates, E2open | WMS/TMS depth, multi‑enterprise networks | Retail, logistics‑intensive operations | Cloud and on‑prem mix |

When steering an SCM selection, executive teams can use the following checklist as a working tool in steering committees and board updates.

Align with strategic objectives

Link SCM initiatives explicitly to resilience, working‑capital release, sustainability, and customer‑service targets for the next three to five years.

Define scope and integration priorities

Separate must‑have from nice‑to‑have modules, and identify critical integration points with ERP, WMS, TMS, procurement, and analytics platforms.

Build a data‑driven shortlist

Use independent research, market surveys, and peer benchmarks to narrow the field to four to six vendors across suites and specialists.

Run scenario‑based demos, not generic tours

Ask vendors to demonstrate performance on real scenarios—demand spikes, supplier disruptions, or logistics capacity constraints—rather than standard demo scripts.

Quantify expected impact before approval

Frame the investment in terms of target improvements in inventory turns, on‑time delivery, and logistics cost as a percentage of sales, then validate assumptions with references and case studies.

Embedding this checklist in the formal governance process helps leadership teams maintain focus on business outcomes rather than purely technical debates.

Leaders seeking a defensible, data‑driven view of the SCM landscape in 2026 can access SoftwareVerdict’s Supply Chain Management Software Market Report and the dedicated SCM software category. These resources provide structured market data, growth projections, and coverage of key players to support investment cases and vendor negotiations.

For organizations preparing an RFP or a board‑level SCM business case, SoftwareVerdict’s broader research and Economic Impact Radar® insights can help translate technical options into quantified financial and operational outcomes.

© 2026 SoftwareVerdict | All rights reserved

SoftwareVerdict and its logo are trademarks of SoftwareVerdict.